Equipment Tax Credits for Primary Residences

Disclaimer: The tax credit information contained found on this website is provided for informational purposes only and is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service (IRS).

High Efficiency Electric Home Rebate Program (HEEHRP)

High Efficiency Electric Home Rebate Program (HEEHRP)

The High Efficiency Electric Home Rebate Program will enable states to provide up to $14,000 in direct consumer rebates for families to buy heat pumps or other energy-efficient home appliances, saving eligible families at least $350 a year on utility bills.

HEEHRP provides HVAC rebates up to $14,000 per household, including:

- Up to $8,000 Heat Pump installation rebate for energy star equipment

- Up to $4,000 electrical panel upgrade rebate

- Up to $1,600 home insulation & sealing rebate

- Up to $2,500 home electrical wiring improvements

Eligibility and the amount of the rebate depends on household income:

- For households below 80% of area median income, 100% of the system purchase price qualifies for the rebate.

- For households that fall within 80% to 150% of area median income, 50% of the system purchase price qualifies for the rebate.

- Households above 150% of area median income do not qualify for the HEEHRP rebate.

Expires: 12/31/2032

Residential Renewable Energy Tax Credit

Residential Renewable Energy Tax Credit

In 2015, the U.S. government renewed the 25C tax credit for Solar Energy Systems installed between 2012-2019. This credit is offered as part of a larger energy-efficiency incentive for home improvements.

The residential renewable energy tax credit incentive provides up 30% on the cost and installation of most of the solar assisted comfort systems available at Charlotte Comfort Systems. The current incentives for installing solar plus the long term savings you’ll receive is well worth considering a solar assisted comfort system for your next home comfort purchase.

**UPDATE 08/18/2022** As part of the Inflation Reduction Act of 2022 signed into law on August 16, 2022, residential energy efficiency tax credits have been extended through 2032. This information applies to the existing tax credits for 2022. Changes to residential energy efficiency tax credits under the Inflation Reduction Act will become effective starting in 2023.

**UPDATE 08/18/2022** As part of the Inflation Reduction Act of 2022 signed into law on August 16, 2022, residential energy efficiency tax credits have been extended through 2032. This information applies to the existing tax credits for 2022. Changes to residential energy efficiency tax credits under the Inflation Reduction Act will become effective starting in 2023.

The previous Nonbusiness Energy Property credit (25C) for installing high-efficiency equipment was extended through 2022 and provides federal tax credits of up to $500.

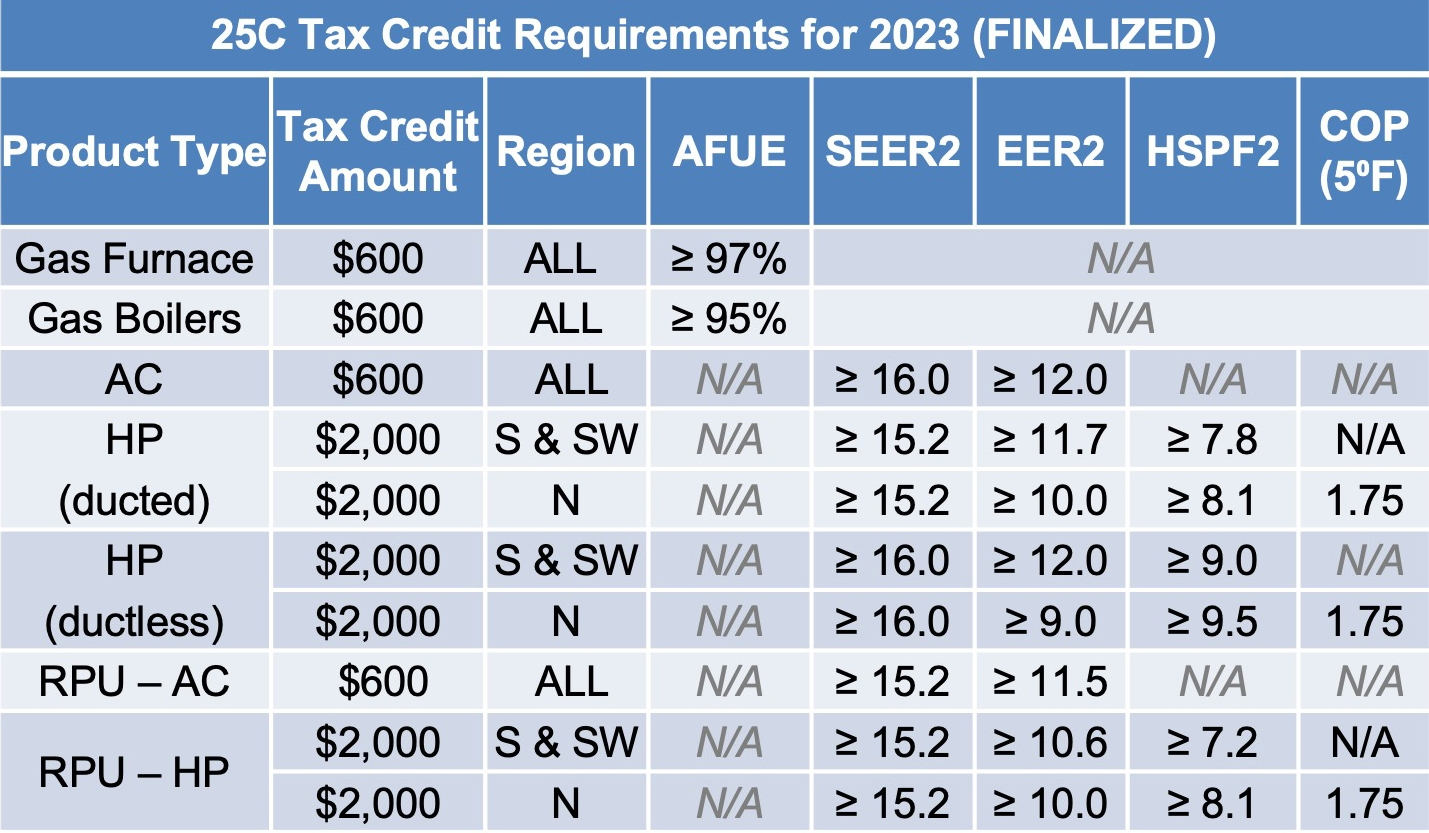

The amended Energy Efficient Home Improvement Credit (25C) begins in 2023 and extends the offering through 2032. It increases the tax credit limits for high-efficiency equipment as follows:

- Up to $600 each for a qualified air conditioner or gas furnace, with an annual cap of $1,200

- Up to $2,000 with a qualified heat pump, heat pump water heater, or boiler.

If you’d like to know more about the Federal Renewable Energy tax credit, visit- EnergyStar.gov

Expires: 12/31/2032

Smart $aver® Eligibility

Smart $aver® Eligibility

Who Is Eligible for Rebates?

Incentives are paid for qualifying heat pumps or air conditioners installed on or after June 1, 2009 for Duke Energy Carolinas electric residential retail customers residing in a single-family home, condominium, duplex or mobile home. Incentives are paid after the qualified system is installed and operating.

If you have additional questions about the Smart $aver program, please call 1-866-785-6209

Smart $aver® Incentive Application PDF (129 KB)

Piedmont Natural Gas Appliance Rebates

Piedmont Natural Gas Appliance Rebates

Did you know?

- Water heating accounts for approximately 15 percent of a home’s energy use

- A new high-efficiency furnace and cooling system can save you up to $1,200 per year in operating costs

Now is the time to cut the cost of heating water and your home by replacing your old inefficient water heater or furnace with a new high-efficiency one. Residential customers in North Carolina who replace existing natural gas equipment with qualifying high-efficiency natural gas equipment are eligible for up to a $300 rebate and may qualify for federal tax credits as well. This includes the following qualifying high-efficiency gas water heaters and furnaces.

Piedmont Natural Gas Rebate Application PDF (104 KB)

Qualified Energy Efficiency Improvements

Please note: Tax credit DOES NOT INCLUDE INSTALLATION FOR THE FOLLOWING PRODUCTS.

HVAC Tax Credit Inquiries

Please use the form below if you have any questions regarding current tax credits. For more details on Federal & State HVAC Tax Credits please visit energystar.gov, dsire.org, or dukeenergy.com.

pellets), plants (including acquating plants), grasses, residues, and fibers.

pellets), plants (including acquating plants), grasses, residues, and fibers.